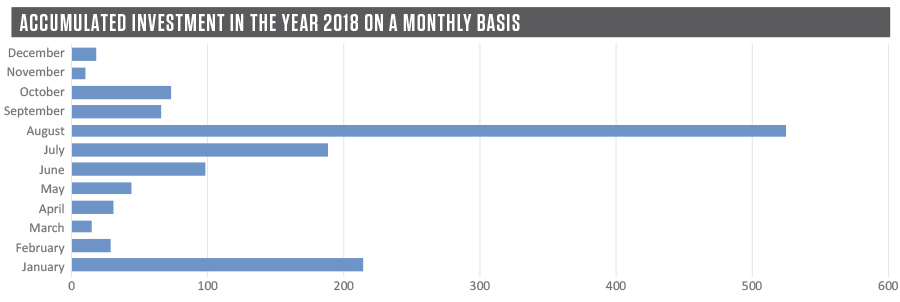

The close of 2018 saw record levels of investment in Spanish startups, with in excess of €1.2 billion raised. The total final figure was €1,227.09 million euros raised across 198 transactions.

The standout transaction was the investment made by South African fund Naspers in the company Letgo. The startup, founded by Spanish entrepreneurs Enrique Lineres and Jordi Castello but incorporated in the US, obtained 430 million euros in funding.

Similarly impressive sums were raised by the next nine startups, closing public transactions in 2018 for an accumulated sum of €431.5m. Those transactions were Cabify (€130m), Glovo (€113m), Travelperk (€38.38m), Spotahome (€33.9m), iSalud (€30m), Ontruck (€25m), Logtrust / Devo (€21.17m), Antai Venture Builder (€20m) and Hawkers (€20m).Four of those companies had already closed major funding rounds in 2017.

The rest of the investment in the year, totalling €364.84m corresponds to public transactions made in 2018, which suggests that the domestic investment ecosystem is reaching maturity.

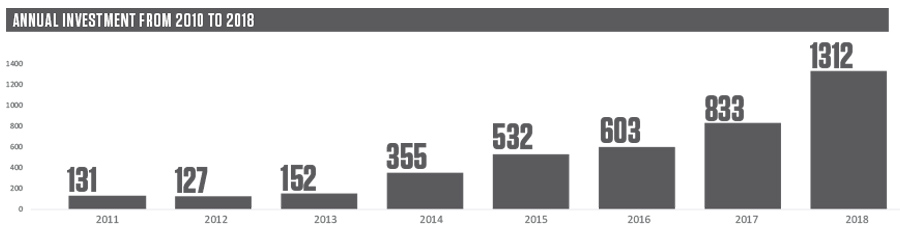

CHANGE OF COURSE IN 2015

The year 2015 marked a major landmark with exponential growth in figures compared to previous years, with more than €500m raised. That figure has not stopped growing in the intervening years and reached record levels again in 2018 in terms of total invested.

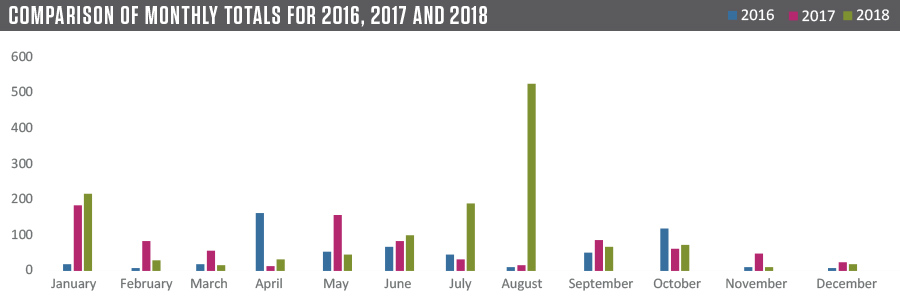

If we look back further, in 2016 there were 182 public transactions in all for a total of €564m. There were many rounds but the sums invested were not as high. This year, there were 6 rounds for in excess of €10m, among them Cabify and Hawkers.

The following year, 2017, a total of 834 million euros was invested in public funding rounds, across a total of 230 transactions (the record in terms of number of transactions in Spain to date). That year saw ten funding rounds for in excess of €10m, including Cabify, Cornerjob, Logtrust, Fintonic and Verse.

It is interesting to see how Spain has matured in 2018, with 22 transactions for sums equal to or in excess of €10m, accounting for 82.1% of the total annual investment in Spain: €1,007.9 million. Among the transactions one company stands out: Cabify, which closed rounds in each of the last three years, becoming Spain’s first unicorn, while others managed to close larger rounds than last year and are on the same path as the company led by Juan de Antonio. They included the likes of Glovo (€113m in 2018 after €25m in 2017), Ontruck (€25m in 2018 after €9.2m in 2017) and Spotahome (€33.9m in 2018 after €13.6m in 2017). All of these rounds shared one common feature: an overseas fund committed to Spanish companies alongside local funds and a clear need for the companies to expand internationally.

THE 10 MOST IMPORTANT ROUNDS OF 2018

1. Letgo – 430 million (10 August)

Letgo, the platform dedicated to the sale and purchase of second hand products obtained 500 million dollars (430.8 million euros) from the South African internet and entertainment group Naspers, its lead investor. 150 million dollars in capital was provided initially while the rest was reserved for release over subsequent months.

2. Cabify – 130 million (23 January)

The holding company for the brands Cabify and Easy, Maxi Mobility Inc., announced the close of a funding round of €130m for expansion in existing markets early last year. The investment was led by the funds Rakuten Capital, TheVentureCity, Endeavor Catalyst, GAT Investments, Liil Ventures, WTI, as well as major local investors in Spain and Latin America. The company is present in more than 130 cities in 14 countries in Latin America and the Iberian Peninsula.

3. Glovo – 115M€ (18 July)

The Glovo platform fine-tuned its business model with a €115m Series C funding round led by the funds Rakuten, Seaya Ventures and Cathay Innovation, who had already invested in the Series B stage. This round also saw the participation of AmRest, the largest restaurant group in Central Europe, and the European funds Idinvest Partners and GR Capital. This new capital injection seeks to continue investment in optimising the platform and technological resources for the purpose of improving the service to distributors, users and partner outlets.

4. Travelperk – €38.38m (16 October)

The Barcelona-based startup TravelPerk raised 44 million dollars in funding in a Series C offering in which the funds Felix Capital, Target Global, Spark Capital, LocalGlobe, Suntone and Amplo all participated. Since its creation in 2015, TravelPerk has increased its income by 700% year on year and has raised a total of 75 million dollars in funding.

5. Spotahome – €33.9m (6 June)

Spotahome raised 40 million dollars in a Series B funding round, led by the investment fund Kleiner Perkins. This was the first transaction in Spain for a Silicon Valley fund and only in the fifth in Europe. Kleiner Perkins led the round along with new and other existing investors, including Passion Capital and Seaya Ventures, TheVentureCity and All Iron Ventures.

6. iSalud – €30m (30 January)

Last January, CNP Partners, the Spanish subsidiary of CNP Assurances announced the acquisition of 60% of the startup iSalud.com, the leading purchase portal and specialized health insurance broker in Spain, for a sum of €30m. The operation was executed through the Spanish subsidiary of the French firm CNP Partners. The transaction marked the exits of the Inveready group and Mediaset as investors in the Spanish startup.

7. Ontruck – €25m (30 May)

The regional road haulage platform OnTruck raised a new funding round of 25 million euros to support its expansion in Europe and consolidate its position in the United Kingdom and Spain. The round, a Series B, was led by the international firm Cathay Innovation. This transaction also saw the participation of new investors GP Bullhound, Atomico, Idinvest Partners, All Iron Ventures, Total Energy Ventures, Point Nine Capital and Sampaipata Ventures.

8. Logtrust – €21.17m (8 June)

Big data analysis company Logtrust raised 25 million dollars (21.17 million euros) in a round led by Insight Venture Partners and which also saw the participation of the Spanish fund Kibo Ventures, which was a shareholder of the company. With this final operation, the company led by Walter Scott has now raised an accumulated total 71 million dollars (60.1 million euros). In October 2017, LogTrust announced its first round of financing for 3 million dollars (29.6 million euros) which was also led by Insight Venture Partners and which also saw the support of Kibo Ventures.

9. Antai Venture Builder – €20m (13 September)

Antai Venture Builder has become one of the leading backers of Spanish enterprise thanks to its financing activity and the fact that it has accompanied many projects through their growth over recent years. And this is set to continue now that it has obtained the investment support of Banco Sabadell and Mutua Madrileña. The platform led by Miguel Vicente and Gerard Olivé opened up its shareholding to two giants of the financial sector, Banco Sabadell and Mutua Madrileña, in an agreement that will allow Antai to access new resources to offer financing to entrepreneurs. Since it was founded in 2012, Antai has become a leader thanks to its business vision and the scalability of its invested companies. They include the marketplace Wallapop, the delivery service Glovo, the search engines Corner Job and ProntoPiso and the online supermarket Deliberry among many more success stories.

10. Hawkers – 20M€ (25 January)

O’Hara Capital, the fund of Venezuelan multi-millionaire Alejandro Betancourt, majority shareholder of the Elche-based sunglass company Hawkers, led a new round of funding for 20 million euros to finance the company’s growth. This was not the first time, as Betancourt had already participated in a funding round for 50 million euros in 2016.