Spain’s tech ecosystem continues to expand and gain economic relevance, with a total of 8,580 active tech companies in 2025 — a 22% increase over the previous year, according to the National Tech Companies Report 2025 published by the data platform Ecosistema Startup. This network of companies generates 108,000 direct jobs and an annual economic impact of €14.8 billion, reinforcing its role as a driver of innovation and growth.

Entrepreneurship is on the rise, with the number of startups growing from 3,640 in 2024 to 5,010 in 2025 — a 38% increase — along with the creation of 28,900 jobs and an economic impact exceeding €1.33 billion.

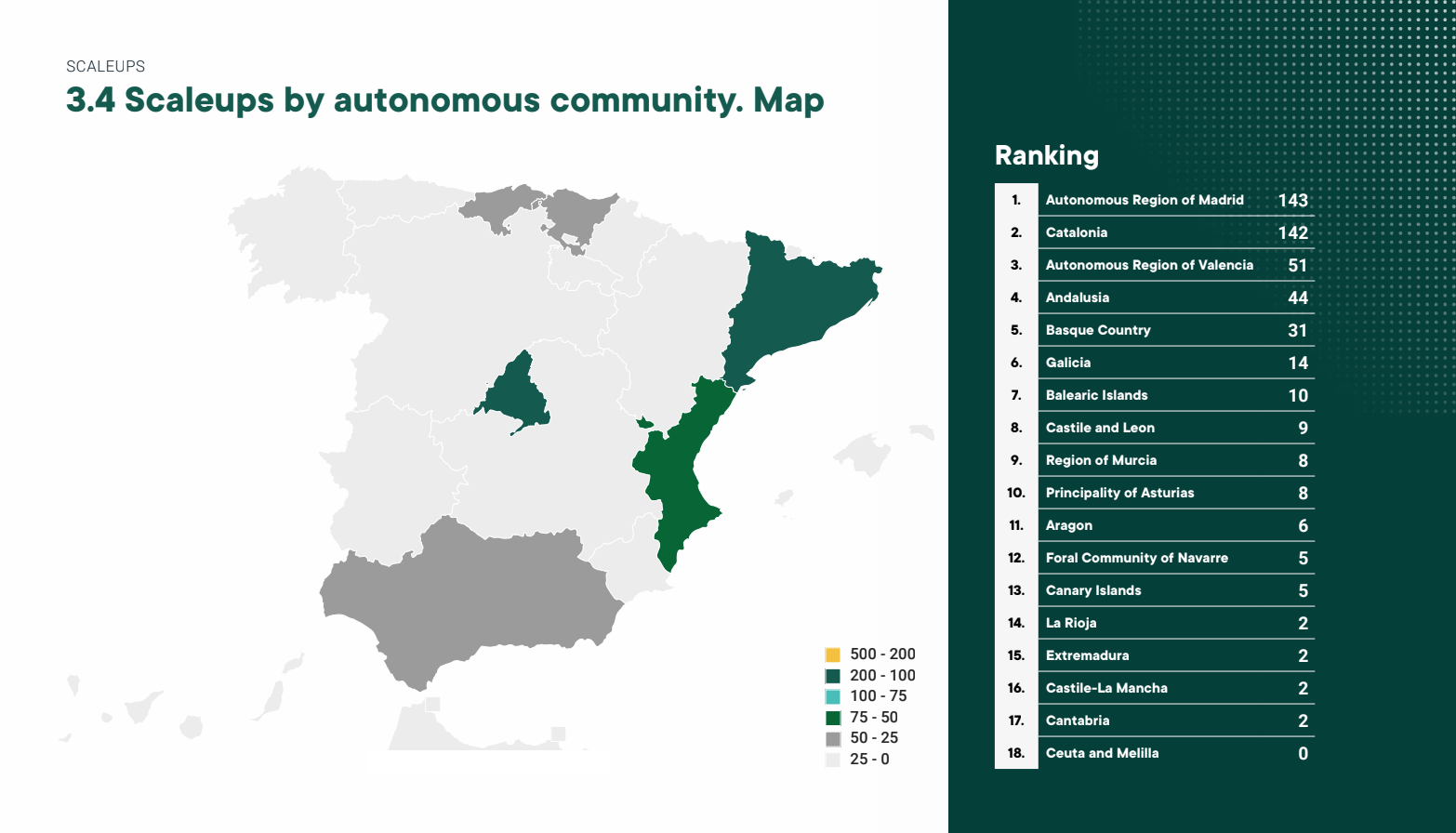

As for scaleups, the report identifies 484 companies that have maintained annual revenue growth above 20% for at least two consecutive years, highlighting this segment’s importance in the ecosystem’s maturity.

Madrid Leads by City, Catalonia by Region

At the regional level, Catalonia remains the community with the highest number of tech companies (2,351), followed by Madrid, which shows strong momentum by adding 512 new firms in just one year, totaling 2,189. The top ten is completed by the Valencian Community (966), the Basque Country (831), Andalusia (714), Galicia (388), the Region of Murcia (207), Castilla y León (139), Navarra (135), and Asturias (124), reflecting the increasing regional distribution of digital talent and enterprise.

By city, Madrid has overtaken Barcelona for the first time in key indicators: number of tech companies (1,560 vs. 1,553), startups (937 vs. 911), and scaleups (112 vs. 93). This shift reflects the capital’s growing dynamism as an innovation and entrepreneurship hub.

According to the report, health remains the most represented sector with 718 companies, followed by biotech (447) and edtech (436). These sectors show the growing intersection of science, technology, and societal services, positioning Spain as a European leader in applied innovation.

The report also identifies 588 active spin-offs in Spain (336 startups, 24 scaleups, and 228 SMEs), with Catalonia (255), Madrid (137), and the Basque Country (84) leading the creation of business projects originating in academic and scientific environments.

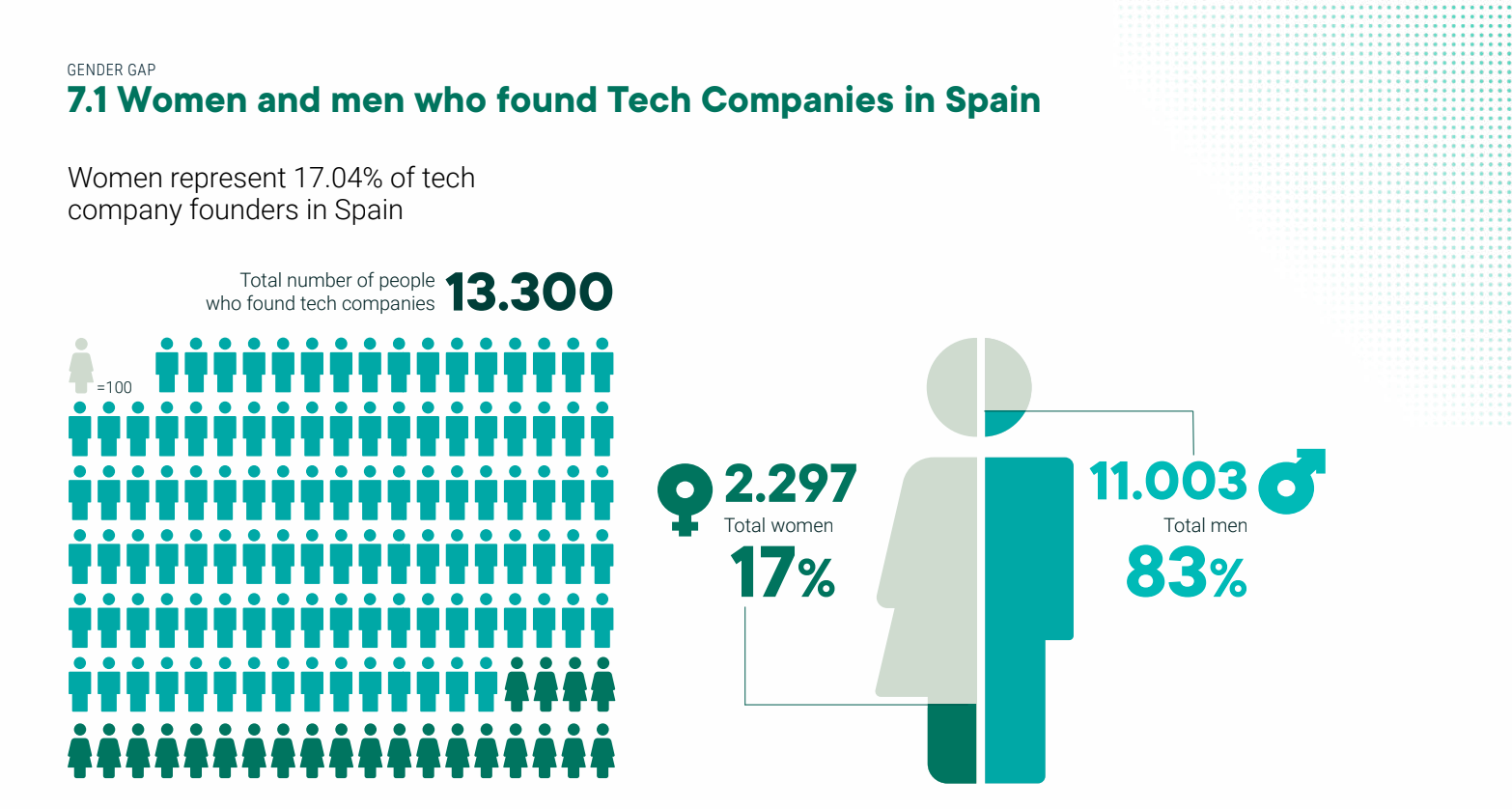

Women Less Likely to Found Alone

The report analyzes 13,300 tech company founders, 83% of whom are men (11,003) and 17% women (2,297). This proportion shows little variation from the previous year and highlights the lack of progress in gender parity.

Women are less likely to start companies alone: only 852 do so without co-founders, compared to 3,676 men. The disparity is even greater in scaleups, where only 10% of founders are women, while the percentage rises slightly to 18% in startups. By region, Catalonia (645), Madrid (581), the Valencian Community (261), and Andalusia (195) have the highest number of female founders, although their proportion still ranges between 17% and 20% of the total.

2024: The Year of Venture Debt and Mega Rounds

The report highlights a sharp increase in investment, which grew in 2024 to €2.92 billion, up from €1.82 billion the previous year. However, this growth is largely due to the rise of venture debt, which surpassed €572 million, accounting for 19.59% of total investment.

The number of deals slightly declined from 337 to 300 compared to 2023, suggesting greater capital concentration in more established companies. In fact, 2024 saw six rounds exceeding €100 million, compared to just one in 2023.

In terms of capital, fintech leads with more than €767 million invested, followed by mobility (€507M), traveltech (€456M), and biotech, energy, and AI.

Despite the progress, structural challenges remain: a lack of national growth funds, a shortage of institutional investors such as insurers and large corporations, and limited exits that would allow capital recycling and fuel new rounds.

More than 8,000 Spanish Tech Companies Analyzed

The report’s methodology is based on data from Ecosistema Startup, the largest database of startups, investors, and business angels in Spain. The analysis includes over 15,000 companies, with a focus on more than 8,000 Spanish tech firms, offering detailed information on founders, sectors, company types, and other relevant metrics. Data is validated quarterly with the Spanish Companies Registry through a partnership with INFORMA, ensuring the accuracy of annual revenue, employee numbers, and company status.

Only companies incorporated in Spain with a tax ID number (CIF) are included. All companies are validated through the Companies Registry, excluding dissolved or liquidated firms, and include only those founded in or after 2010, with occasional exceptions. Companies are categorized into three types (startups, scaleups, and SMEs) based on annual revenue and age. Location is determined by tax address, obtained from the Registry via INFORMA. Data was collected and updated through May 10, 2025.

The report has been supported by institutions and companies such as ENISA, ICEX, Santalucía, Xunta de Galicia, INFO Murcia, CEIN Navarra, Grupo SPRI, CEEI Valencia, and Fundación para el Conocimiento Madri+d, who collaborated in the regional scouting process alongside Ecosistema Startup.