Investment in startups during 2021 continues to break records each month; April closed with €271,919.34 million invested in a total of 36 operations, beating the annual record in number of operations. With these figures, 2021 will set an all-time record for the amount of investment received in startups. Between the first four months of the year, €1,767,271.16 million have been obtained in a total of 131 operations, compared to the €234.39 million obtained in the first four months of 2020 in a total of 75 operations.

Every month this year, technology companies announce astronomical investment rounds, and this April Travelperk is the startup that achieved a million-dollar round (€132 million) so that at the last minute (it announced the round on the 30th) the accumulated figure is over €270 million. Userzoom, which closed an €85 million deal led by Owl Rock last April, is also partly responsible for the record.

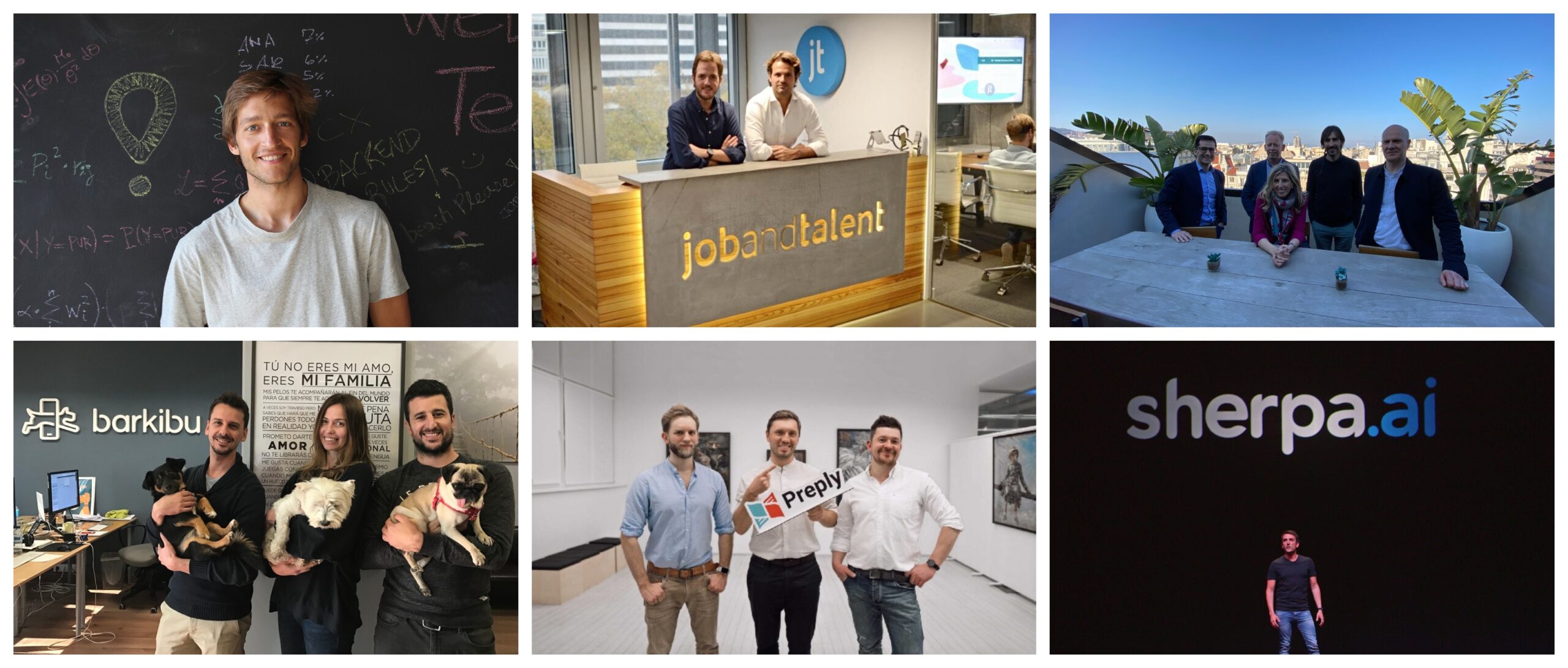

This year’s increase in investment is partly thanks to the million-euro rounds announced in the first four months of this year by Jobandtalent (€88m and €100m in two rounds in January and March) and Idealista (€175m and €250m in two rounds in January and March), Wallapop (€157M), Preply (€29.5M), Wallbox (€33M), Koa Health (€30M), Glovo (€450M) and the aforementioned Travelperk (€123M) and Userzoom (€85M).

INVESTMENT ROUNDS

TravelPerk: the Barcelona-based company has announced the closing of a Series D investment round of €132.37 million ($160M), led by UK investment fund Greyhound Capital. The capital injection will help the company led by Avi Meir to strengthen its presence in the United States and Europe.

UserZoom has closed a €85 million ($100M) investment round that will enable it to enhance its technology services. US venture capital firm Owl Rock led the deal. The capital raised will allow the startup to improve its user experience (UX) services and expand its platform to new customers.

Satlantis: the company chaired by Jean-Jacques Dordain has benefited from the entry of Enagás as a shareholder, following a capital increase of €14 million. SEPIDES, ORZA, AXIS-ICO and the Provincial Council of Bizkaia have also entered the operation.

Amovens: the collaborative mobility company and its Danish parent company GoMore have closed a financing round of €7.3 million. Of this, most of it came from the Swiss insurance giant Baloise Group, which has contributed approximately €5 million.

Abacum: the financial planning platform for mid-sized companies, has closed a €5.89 million ($7M) seed round.

The deal was led by European fund Creandum, an early-stage investor in companies such as Spotify, Klarna and iZettle. The round was also backed by previous investors in the startup, including Y-Combinator, PROFounders, K-Fund and several business angels.

Atani: the startup that offers a comprehensive platform for investors and traders in cryptocurrencies has closed a financing round of €5.3 million. Funds such as JME Ventures, which led the round along with Conexo Ventures, Encomenda Smart Capital, and Lanai Partners, as well as numerous private investors, participated in this round.

Ritmo: the company has closed its first round of financing, led by Sabadell Venture Capital, Inveready and JME Ventures, for a value of €3 million.

With the entry of this capital, the company maintains a hybrid structure of Equity and Venture Debt in its financing that will allow it to meet the goal set for this year of financing €15 million to digital businesses with recurring or predictable revenues.

Aortyx: the company has raised €2.4 million in its second round of investment. This investment has been obtained through Capital Cell, and included investors of great relevance, such as Medex Partners or family offices of the Catalan ecosystem, such as Vergara Capital.

mediQuo: the startup has closed a new financing round of €2.3 million in which Encomenda Smart Capital and Dozen Investments participated.

This will serve to commercially expand the leading TeleMedicine platform that connects healthcare professionals and their patients. It will also allow it to consolidate its product vision, develop its commercial strategy and maintain its positioning in Spain and Latin America.

Psquared: the company that captures strategic real estate assets and transforms them into flexible, talent-focused workspaces has closed a €2 million investment round.

Roka Furadada: the Barcelona-based dermatological health startup has successfully completed a Series A funding round of €1.5 million. The capital increase was led by the investment group O Financial Club, the business angel network “Women Angels for Steam”, which supports women entrepreneurs in STEAM, and existing partners, led by Menadiona, the project’s industrial partner.

STAYmyway: the technology provider of digital or mobile key for hotels and tourist flats, has received a capital injection amounting to €1.2 million. The Murcian startup has managed to attract various investors, such as the Travel Tech group, which has led the round along with Tokavi Activos, several national and North American business angels of recognized prestige.

Other startups that have closed investment rounds of one million euros or less complete the public operations of April; this is the case of Agrosingularity (€1M), Ienai SPACE (€1M), Shapelets (€1M), Gocleer (930,000 euros), Dudyfit (700,000 euros), Okticket (700,000 euros), Nova Talent (524,469 euros), Bionline (500,000 euros), Caelum Labs (500,000 euros), Acqustic (425,000 euros), full&fast (300,000 euros), Kampaoh (300,000 euros), Triple O Games (250,00 euros), WakeUp & Smile (200,944 euros), Renty (200,000), Glasskin (183,400 euros), Oasis Hunters (135,000 euros), miResi (100,000 euros), Atravo (100,000 euros), Familiados (100,000 euros) and Naturcode (90,000 euros).